GlobalData analyst Al Bedwell has told delegates at the GlobalData Automotive Europe Conference in Munich that Europe’s electric vehicle market has come to life in 2025.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Bedwell showed data for pan-European BEV sales in the first eight months of the year at 1.66m units (passenger vehicles – cars) – some 32% ahead of the same period in 2024 for a market share of 17.9% versus 13.7% in 2024.

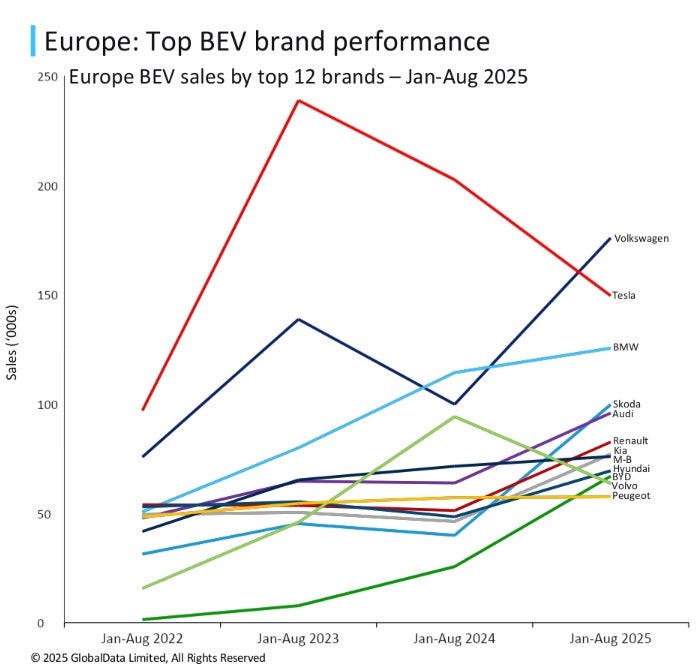

Analysis of brands presented by Bedwell showed that European brands are ‘asserting themselves over Tesla’, the BEV market leader for a long time but seeing slower sales in 2025. According to GlobalData’s figures, the Volkswagen brand is now ahead of Tesla, but Chinese car brands are strong in BEVs and growing fast.

BYD is 10th best-selling BEV brand in Europe in 2025 so far, but the fastest growing of the top 12 (+162% – 66,902 units sold Jan-Aug 2025 versus 25,562 in Jan-Aug 2024).

Bedwell also said that expanded BEV model choice in Europe is a factor driving growth and that average price for BEVs is coming down. “More affordable small BEVs such as Citroen’s e-C3, the Dacia Spring, Renault 4 E-Tech and Leapmotor T03 will continue to attract more consumers to BEVs,” he said.

However, he also expects EU-wide targets for the phasing out of ICE vehicles to be pushed out. “That means some revision to our BEV outlook,” he said. “They will still be growing but some BEV sales in future years will now be lost to ICEs and hybrids.“