It has been a busy week on Just Auto and a lively one across the world’s automotive industry and markets. These articles caught our eye.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Stellantis makes waves in North America

Stellantis grabbed attention when it said it is planning a huge $13bn manufacturing investment programme for the US over the next four years. Stellantis wants to increase annual finished vehicle output in the US by 50% compared to current levels. Wow. The company said the outlay is the largest in its 100-year US history: Stellantis targets US expansion with $13bn investment.

Unsurprisingly, the reaction in Canada to a plan that involves a shift of Jeep production south of the border was less than positive: Canada warns Stellantis over plan to shift production to US. Canada’s Unifor labour union was pretty robust in its response.

“Canadian auto jobs are being sacrificed on the Trump altar,” said Unifor National President Lana Payne.

It’s going to be something to watch as the US continues to reset bilateral trade and investment relationships – with so many countries – and in such an unpredictable way, with huge multi-national companies caught in the wake of that.

Canadian labour union strongly opposes Stellantis NA plan

China’s overseas boom continues

China’s auto industry continues to out-perform the global auto market, especially in electrified vehicles. Chinese vehicle sales (including exports) were up 15% in September, driven by soaring overseas shipments – there’s still a pretty brutal price war at home. Global Chinese OEM sales of new energy vehicles (NEVs – BEVS and plug-in hybrids) rose by over 35% to 11.2m units year-to-date, accounting for over 46% of total deliveries by the country’s automakers.

Chinese vehicle sales (including exports) up 15% in September

China’s vehicle makers are also forging ahead with FDI across the world. Take BYD for example:

- BYD launches hybrid with biofuel tech in Brazil

- BYD plant for Spain ?

- BYD launches EV sales in Argentina amid tariff exemptions

And from Xpeng: Xpeng expands further into North Africa

SAIC in southeast Asia: SAIC to launch vehicle assembly in Malaysia in 2026

General Motors gets a China boost

General Motors and its joint ventures in China have reported nearly 470,000 vehicle deliveries in the third quarter, up 10.1% year-on-year. It marks a second straight quarter of annual growth in both China sales and market share in 2025.

The US company said demand for its new energy vehicles (NEVs) remained a key driver.

Less positive news for GM though was weak EV demand in the US: GM to take $1.6bn charge amid EV strategy overhaul.

London Waymo calling

Google/Alphabet-owned ride-hail firm Waymo announced it is expanding to London, where it intends to offer fully autonomous ride-hailing services starting next year. London will be Waymo’s first European city and its second international city alongside Tokyo.

Waymo plans driverless ride-hail for London in 2026

Outlook for Indian vehicle market lifted by tax cuts

The outlook for automotive demand in India is looking up. Demand is expected to rise following the GST rate cut on automobiles and household items, which should lower costs and increase disposable incomes. The ongoing festival season, combined with price reductions from lower GST rates and aggressive marketing, is also likely to further stimulate demand.

This translates to a projection of a 3% YoY increase in India light vehicle LV sales in 2025, reaching 5.1m units.

Full GlobalData report: Outlook for Indian vehicle market lifted by tax cuts – Globaldata

Hyundai in India had an IPO not so long ago, and has just held its first Investor Day. Big plans ahead: Hyundai to invest over US$5.1bn in India by 2030

Interviews published this week

Fascinating insights here into how AI will be shaping the development of future car models: Controlling AI without voice command: The future of SDVs?

Some perspective on the long-term demise of the combustion engine from Johnson Matthey (there’s going to be a long tail in the road to decarbonisation): Johnson Matthey sees sustainability opportunity ahead for ICEs

Maserati’s ‘lightning’ charge

Oh, and Maserati now has an EV. There is inevitably considerable mass due to battery size, but the car comes with genuine sports performance and some interior materials sourced from recycled fishing nets: Grecale Folgore – Maserati’s first EV

Quote of the week

BYD founder and CEO Wang Chuanfu said: “After two years of effort by more than 100 Chinese and Brazilian engineers, today our 14 millionth vehicle rolls off the production line equipped with the world’s first plug-in hybrid engine dedicated to biofuel. This is not just a technological breakthrough – it is a green and sustainable solution tailor-made for Brazil.”

BYD launches hybrid with biofuel tech in Brazil

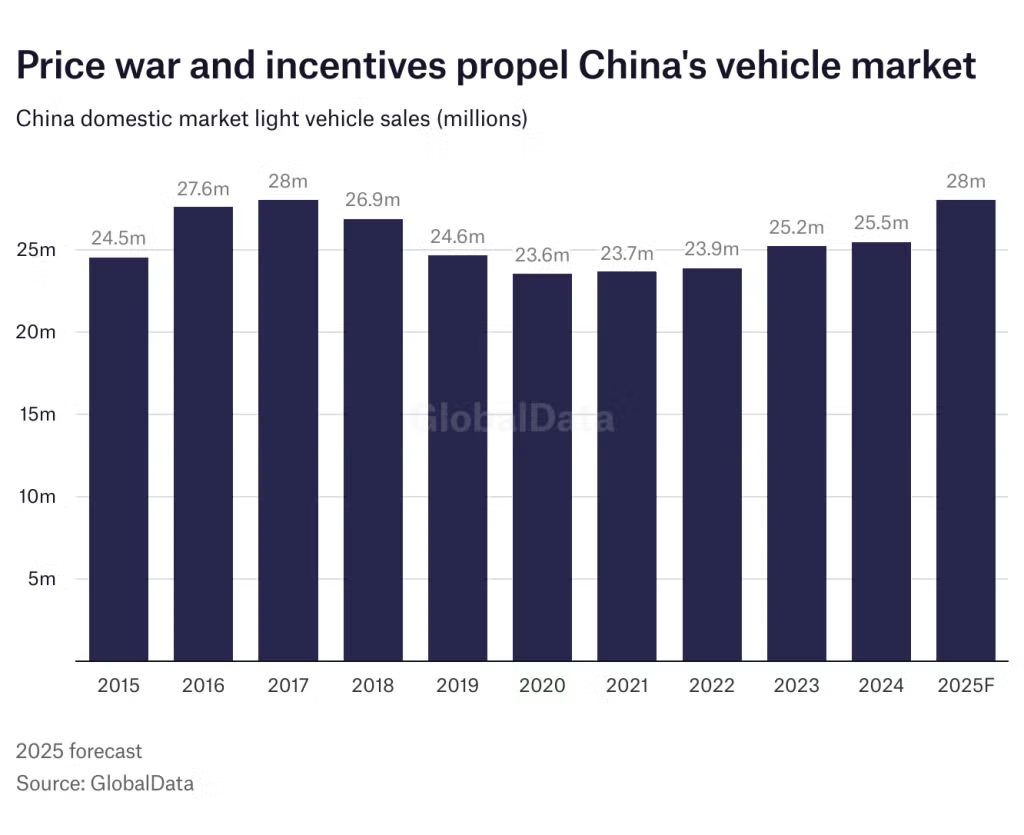

Chart of the week