As US auto tariffs bite and global competition intensifies, the finance arms of Toyota, Honda, Nissan, Hyundai, and Kia must pivot fast.

When Toyota’s chief financial officer addressed investors in early August, his message was anything but reassuring. He revealed that US tariffs had carved a staggering ¥1.4 trillion — nearly US$9.5 billion — off the company’s full-year operating profit. That figure, part of a 16% downward revision to ¥3.2 trillion, marked the sharpest tariff-related impact estimate yet from any global automaker, according to Reuters.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The announcement followed a July 22 decision by US President Donald Trump to lower tariffs on Japan-made vehicle imports from 25% to 15%, with a similar rollback for South Korean-made vehicles announced just before the August 1 deadline.

Industry observers welcomed the move as a reprieve from potentially harsher trade penalties. But relief was tempered by realism.

“I’d hesitate to call it good news. A 15% US import tariff is still significantly higher than where Japan started — and higher than most had expected,” said Stefan Angrick, head of Japan and Frontier Market Economics at Moody’s Analytics, according to CNBC.com.

Asian automakers, including Hyundai, are experiencing “unprecedented” profit erosion in Q2 2025, even as US sales show modest gains. Hyundai reported a 22% drop in net profit, absorbing a ₩828 billion (US$604 million) tariff hit, according to the Financial Times.

Mitsubishi Motors saw its net profit nearly wiped out, falling from ¥29.5 billion ($201 million) a year earlier to just ¥14.4 billion, largely due to tariffs and increased incentive costs. Sales also dipped 3% to ¥609 billion, the FT reported.

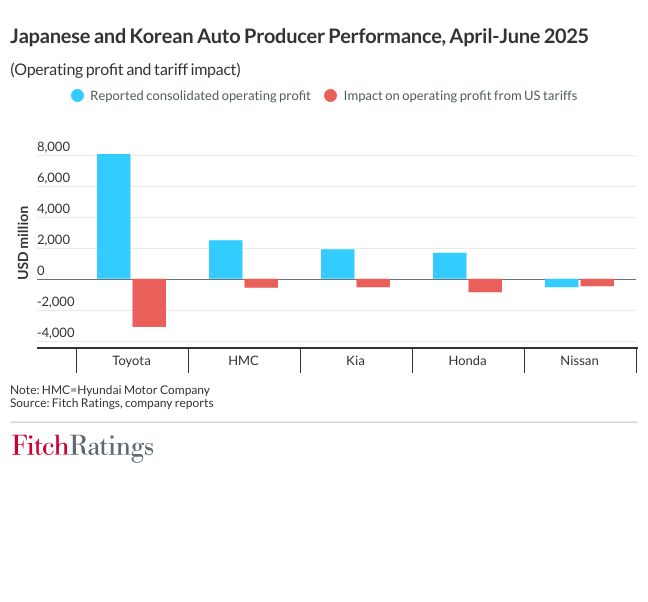

Fitch Ratings warned on August 15 that US auto tariffs continue to weigh heavily on the financial health of Japanese and Korean automakers. While Japan’s direct exports to the US are relatively limited, Korean manufacturers are more exposed to the new 15% tariff rate. Both countries, however, remain vulnerable to tariff risks tied to other export hubs — particularly Mexico and Canada — where trade terms are still unsettled. Fitch also noted that the long-term impact on component and raw material costs remains unclear.

So far, Japanese and Korean carmakers have been reluctant to pass tariff-related costs directly to US consumers. Fitch expects them to prioritise internal cost-cutting measures, though gradual price increases are likely, especially if competitors follow suit. The extent to which these companies can shift costs to buyers will play a key role in determining how much financial strain they face.

Currency fluctuations will also be a factor. The yen and won both strengthened by roughly 9% against the US dollar in the first half of 2025, diminishing the value of US sales when converted to local currency, Fitch added.

The China challenge

While tariffs dominate headlines, a deeper challenge looms: China’s rise as a global automotive powerhouse. Once a vital growth market for Japanese and Korean brands, China has evolved into a formidable competitor. As domestic demand weakens in Japan and Korea, automakers now face intensifying competition from Chinese rivals, both at home and abroad.

With poor corporate operating performance on the horizon – even with the rollback to 15% – and Chinese manufacturers in the ascendency, especially when it comes to must-have electric vehicles, where does this leave captive finance operations?

Captive in the firing line

At the core of every Japanese and Korean captive finance provider — Toyota Financial Services, Honda Finance, Nissan Financial Services, Hyundai Capital, Kia Finance — is a delicate balance of credit, risk, and customer trust. When tariffs drive up vehicle costs and squeeze manufacturer margins, the impact doesn’t stop at the factory gate — it reaches the car buyer.

Manufacturers absorbing tariff shocks often choose to swallow costs to preserve market share. This compresses auto profits and limits their ability to subsidise financing deals, making generous leasing terms harder to sustain. The result? Consumers may face stricter credit assessments, higher down payments, and less favourable lease options. In some cases, captives may pivot toward used-vehicle financing, where margins are more manageable and demand remains resilient.

In this environment, captive finance divisions are no longer passive enablers — but become stabilisers of sales and customer loyalty. To stay competitive, captives will come under pressure to redesign customer touchpoints — to offer refinance incentives, loyalty discounts, and lease adjustments to keep buyers engaged.